Introduction

The Banknifty Option Chain is a key tool that assists traders and investors in the sphere of financial markets. It is a comprehensive big picture of the exchange-traded derivatives whose prices are based on the Banknifty Index and also it is a benchmark against which the participants can assess their choices. After that, we are going to discuss the banknifty option chain in detail and highlight its impact on the dynamic trading business.

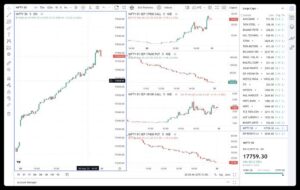

Understanding the Banknifty Option Chain

The Banknifty Option Chain shows the visual with Banknifty Index index options contracts. It affords strike prices and an array of puts and calls with data on open options, volume, and volatility. Traders use this data to weigh the state of the market, predict price fluctuations as well as employ a strategy that will enhance profit.

Components of the Banknifty Option Chain

Strike Prices: The Banknifty Option Chain gives the strike prices already predefined at which point of the time the options can be executed.

Call Options: Inside the Banknifty Option Chain, the Calls offer the holder the privilege to buy the Bank Nifty Index with a standard amount (strike price) for a certain time.

Put Options: In contrast, call options give the investor an option of buying at a set price and during a given time (which is known as the strike price).

Open Interest: Open interest in the Banknifty options market is the total quantity of the options contracts that are still open at a certain strike price.

Volume: In the perspective of options contracts, volume is the quantity of contracts that go up and down in a designated interval.

Implied Volatility: Implied volatility underlines the collective expectations of traders regarding the likely changes in course for the BankNifty index.

Analyzing Banknifty Option Chain Data

Directional Strategies: A directional movement of the Banknifty index, which may be anticipated by traders, could make long call / put options attractive for traders who would like to seize on upward or downturn price trends respectively.

Volatility Strategies: Volatility is an indicative element of options value and therefore straddles and strangles being volatility-based strategies are widely used among traders. These strategies involve buying or selling the call and putting options with the same strike price and expiration date to take advantage of price fluctuation and being direction independent.

Income Strategies: Income-generating techniques, for example, the covered calls and the cash-secured puts, are intended for capitalising on markets with a stable nature or ranged stocks. These tactics include the selling of option contracts against existing positions to generate premium income

Risk Management: Hedging through options contracts (a variety of option strategies) helps cover the downside losses, and guard the capital against unfavourable environmental movements. Traders may use put options and collars in their efforts to protect themselves from excessive losses while still being exposed to the possibility of gains.

Conclusion

Finally, the Banknifty Option Chain is a great tool for all traders who are looking to master the provisional world of derivative markets. It does this by feeding very important data and insights to the market players so that they can make the right strategies based on that information to meet their objectives. The possibility to manage risks, generate income or speculate on the stock movements is available to every trader as the Bank Nifty hasa myriad of trading opportunities.